Learn About Flex Loans through Parafin

12/20/2024

Summary

What is a Flex Loan and how does it differ from a term loan?

- A Flex Loan is a one-time lump sum with daily repayments based on a fixed percentage of gross sales, unlike term loans which have biweekly fixed repayments.

- Flex Loans have no interest, only a flat fee, and repayments are flexible with no late fees or prepayment penalties.

What is the application process for obtaining a Flex Loan through TikTok Shop?

- Eligibility is based on TikTok Shop sales, not credit score, and involves verifying business and personal details.

- Applicants must link their bank account for automatic daily repayments; funding can be received in as little as 1 business day if approved.

What can Flex Loan funds be used for, and are there any restrictions?

- Funds can be used for business purposes like inventory, marketing, fulfillment, payroll, and product expansion.

- Flex Loans cannot be used for personal or household expenses.

How are repayments for a Flex Loan structured and managed?

- Repayments are automatically debited daily from the bank account linked to TikTok Shop payouts, based on a fixed percentage of gross sales.

- There is a 30-day required minimum payment amount, visible in pre-approved offer details.

What is a Flex Loan?

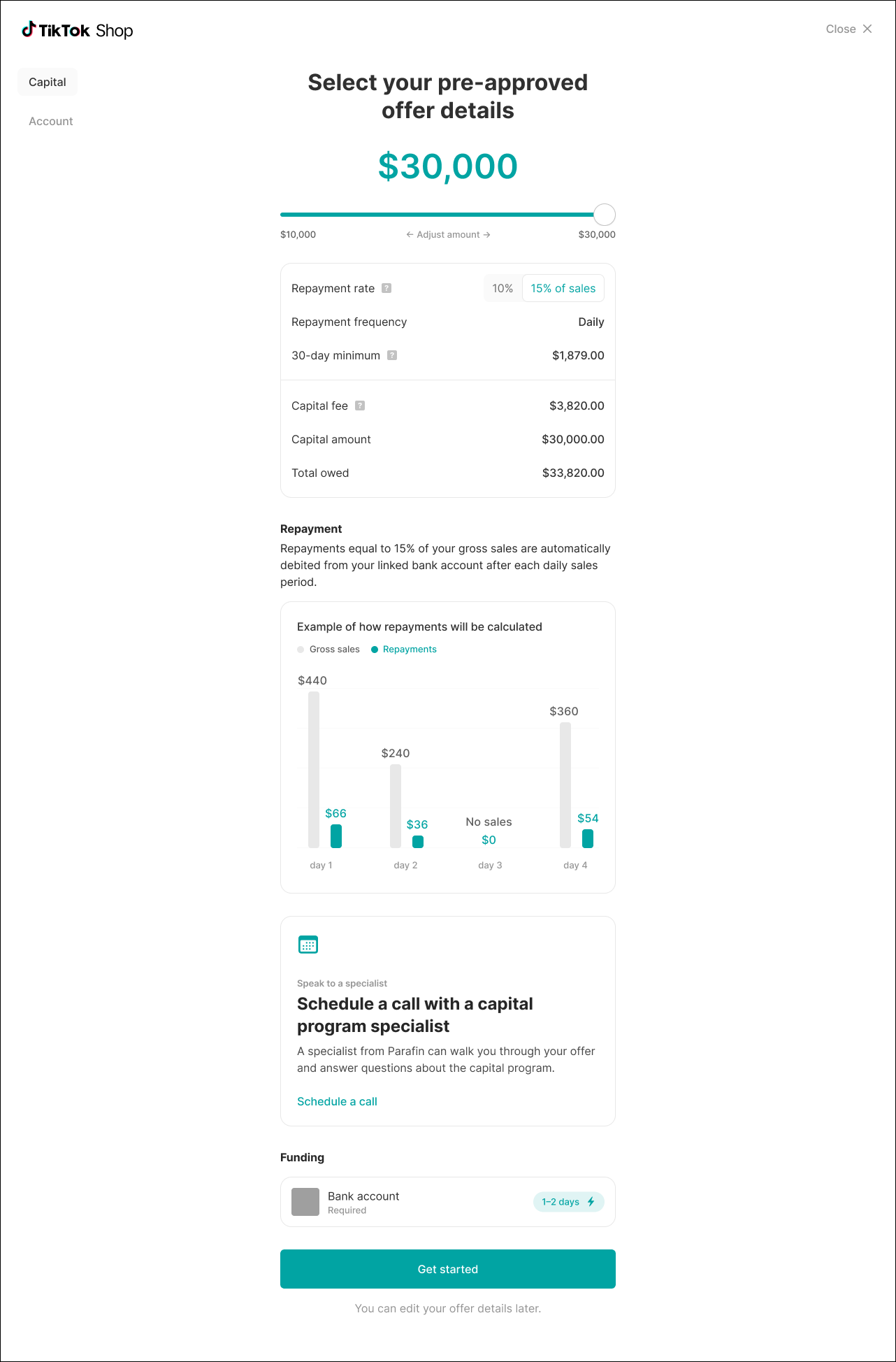

Parafin, our third-party partner, provides access to fast and flexible financing to help grow your business. A Flex Loan is a one-time lump sum amount. However, unlike a conventional term loan, repayments are daily and based on a fixed percentage of gross sales. Repayments are automatically debited from the bank account associated with your TikTok Shop payouts. There is a 30-day required minimum payment amount, which you will see in your pre-approved offer details.How does it work?

Easy Application

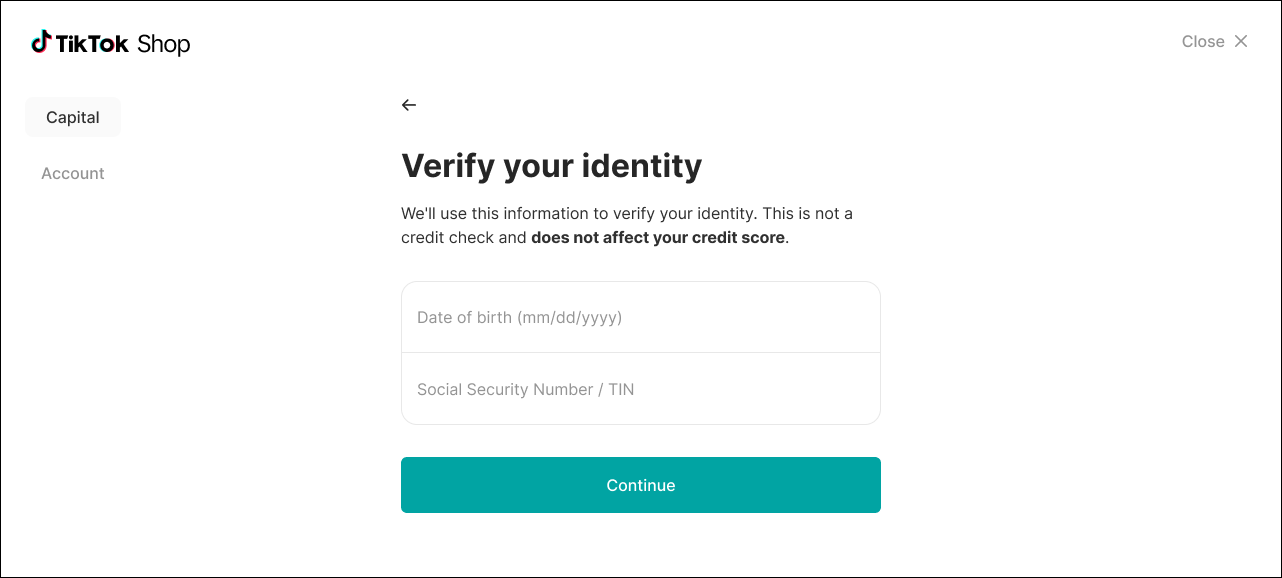

Eligibility is based on your TikTok Shop sales, so applying will not impact your credit score. There are no credit checks (hard or soft inquiries).Quick Funding

If approved, you can get funding in as little as 1 business day. Most approved sellers complete the application and get funds in 1-2 business days.One Fixed Fee

There is no interest, just one flat fee that is paid over the term of the loan.Sales-based Repayments

Repayments are based on a fixed percentage of gross sales. They are automatically debited from your bank account every day. Since repayments are flexible, there are no late fees or prepayment penalties. There is a 30-day required minimum payment amount, which you will see in your pre-approved offer details.What Is the Difference Between a Flex Loan and a Term Loan?

If you’re looking for information on term loans, please visit here.| Term Loan | Flex Loan | |

| Offer size | Up to $2M | Up to $2M |

| Eligibility criteria | Sales historyDepending on your offer, we may ask for additional documents like bank statements or tax returns. | Sales historyDepending on your offer, we may ask for additional documents like bank statements or tax returns. |

| Application time | Typically 1-2 business days | Typically 1-2 business days |

| Cost | One fixed fee | One fixed fee |

| Repayments | Biweekly repayments that are based on a fixed amount | Daily repayments that are based on a fixed percentage of gross sales. Repayment amounts are based on gross sales, not payouts, and do not take reserves into account.There is a 30-day required minimum payment amount. You will see this amount in your offer details. |

What Can I Use a Flex Loan For?

You can use the funds for business purposes such as inventory, marketing, fulfillment, payroll, product expansion, and more.What Is the Application Process?

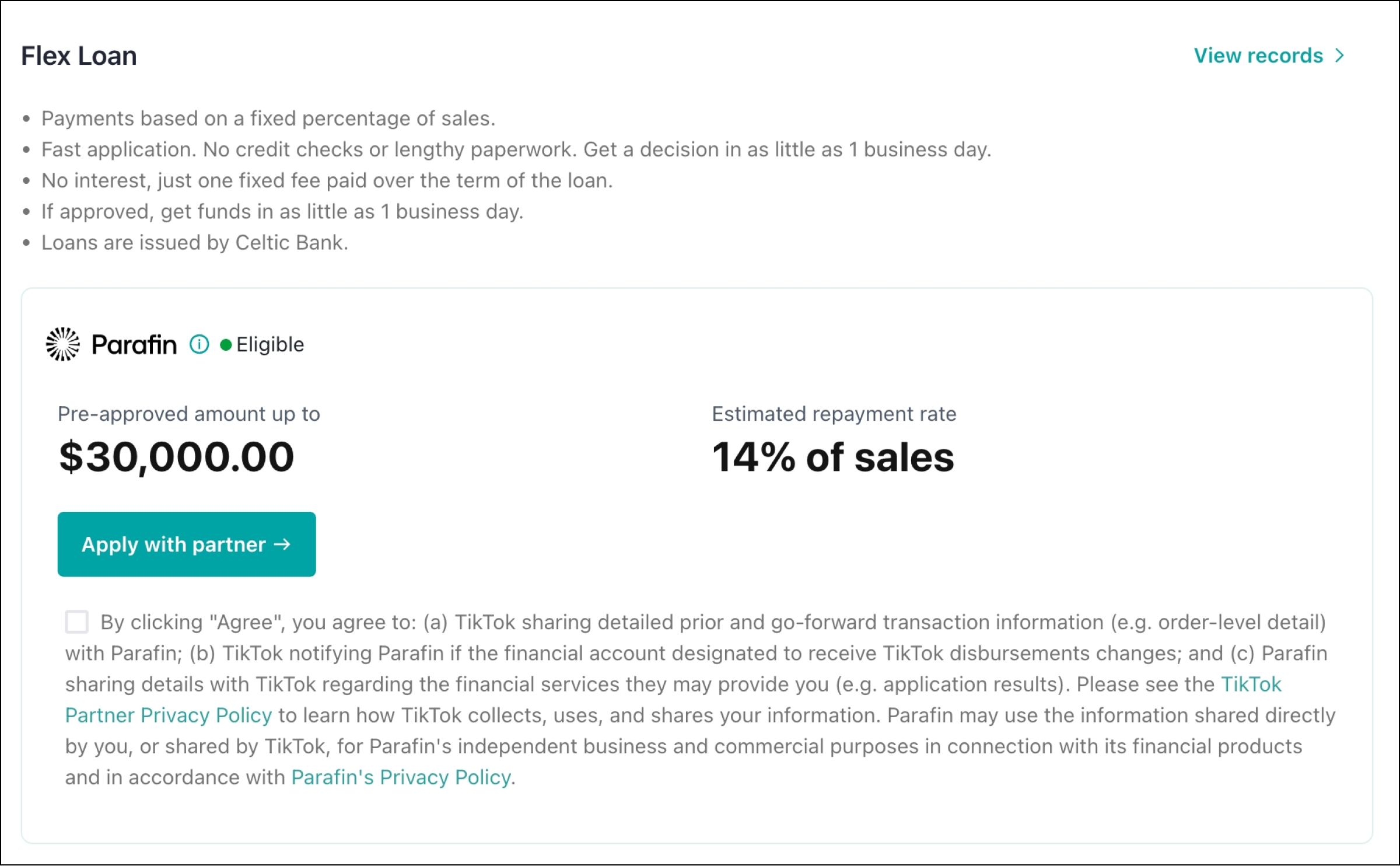

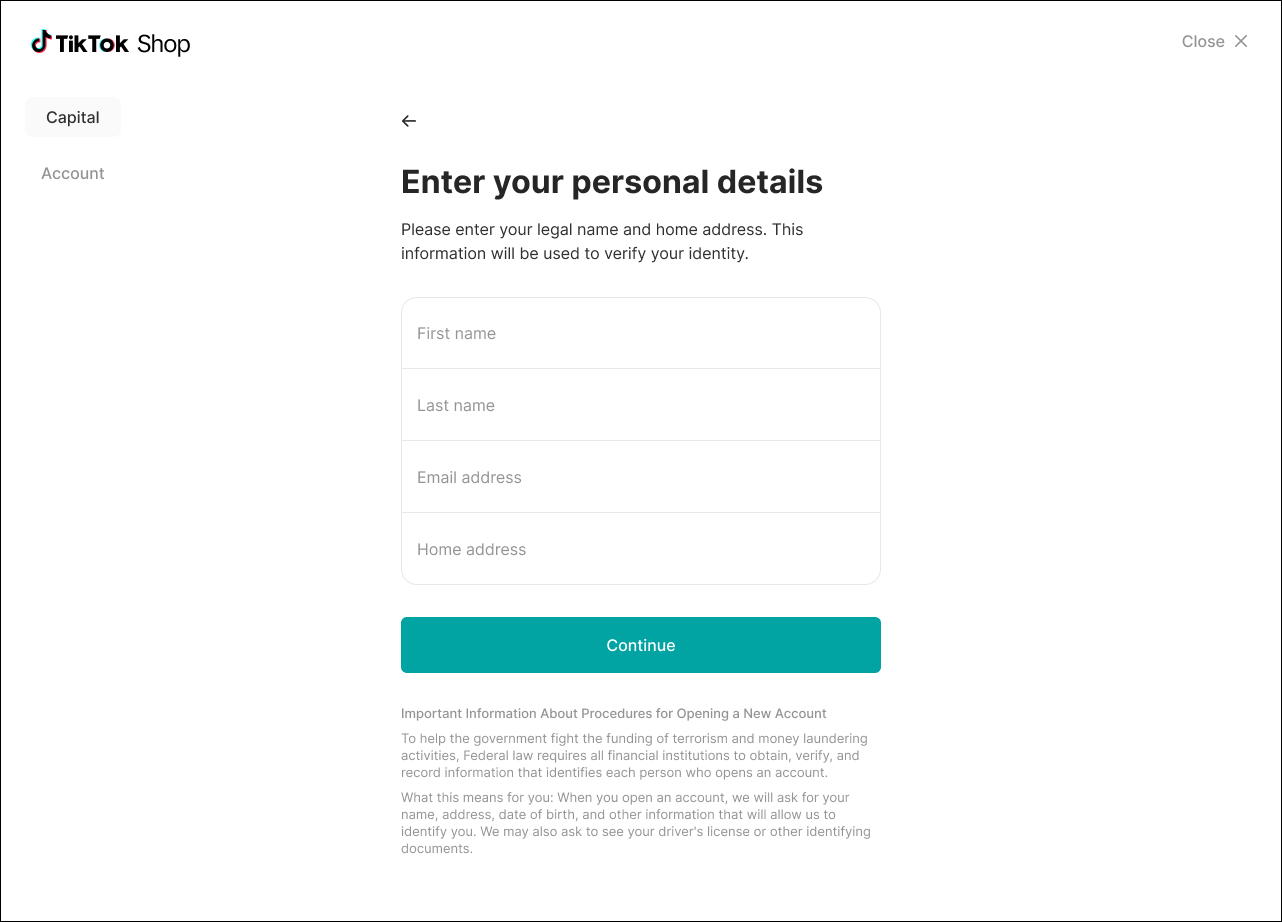

The application is primarily verification of business and personal details. There are no credit checks, so applying will not impact your credit score. In some cases, Parafin may ask you for additional documents. Here is an example of our application process, starting with the Capital page in Seller Center.- See if you're eligible through the Capital tab in Seller Center. If you are interested, agree to share your sales data with Parafin and view your pre-approved offer.

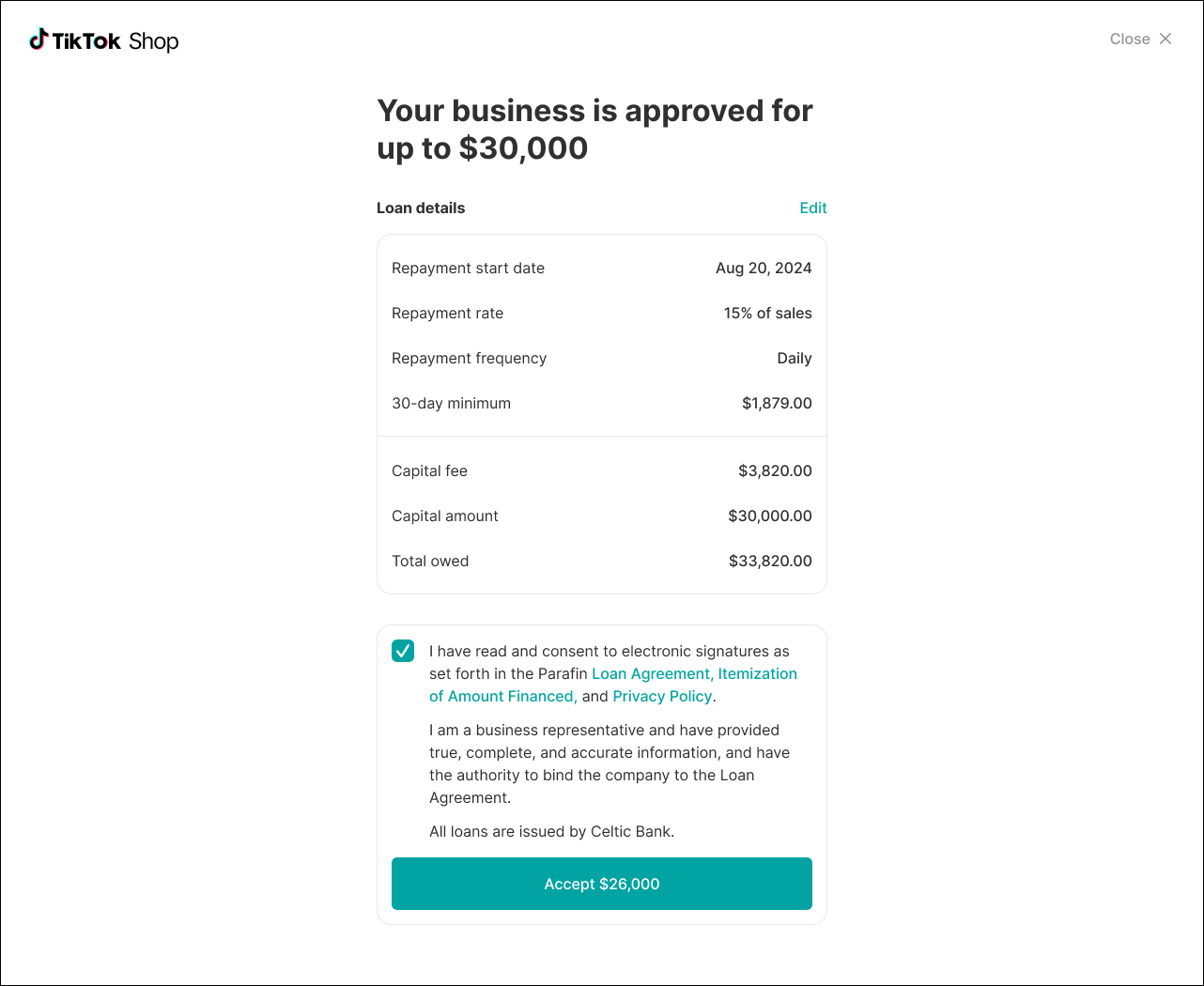

- If eligible, view details and select your pre-approved offer amount.

- Verify your legal name and home address.

- Verify your date of birth, and SSN or TIN.

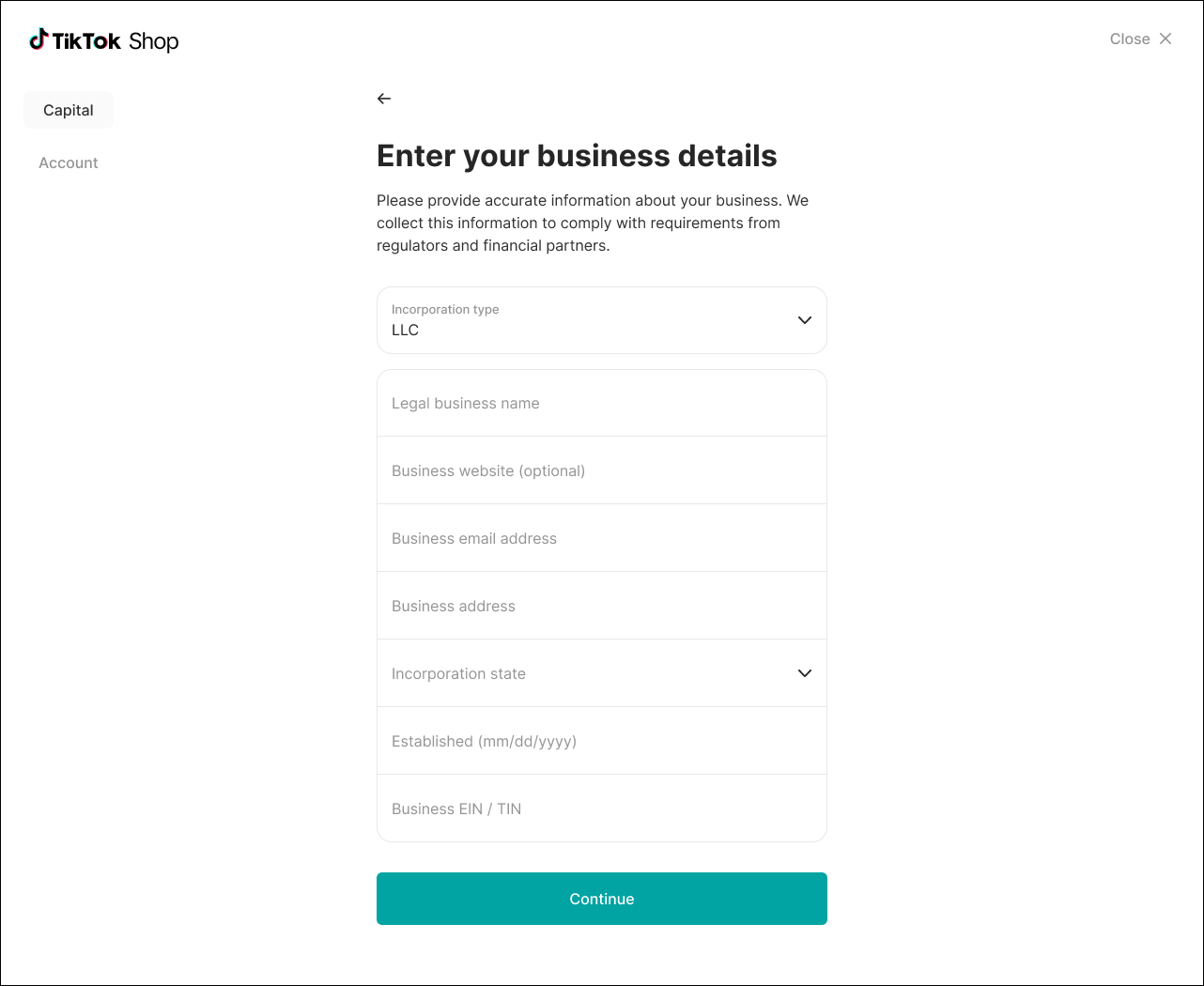

- Enter your business details.

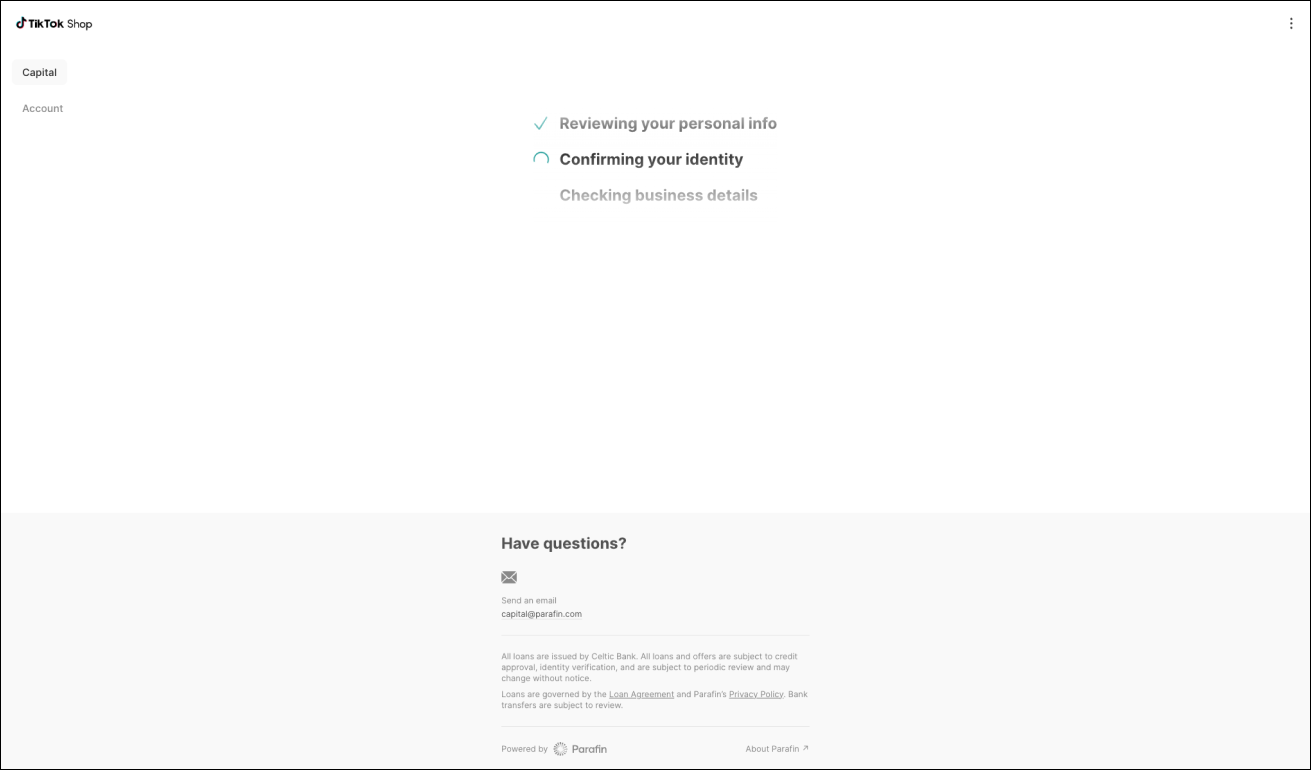

- We'll check the information you submitted. This may take a few moments.

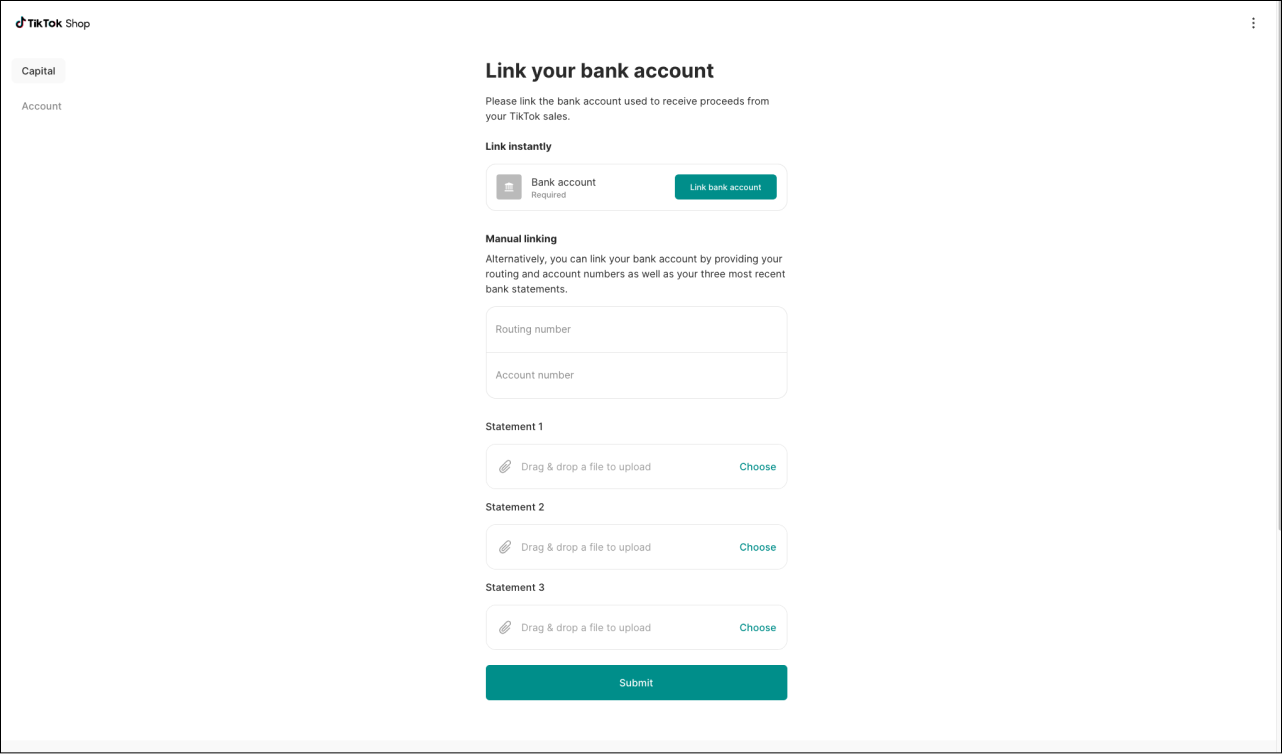

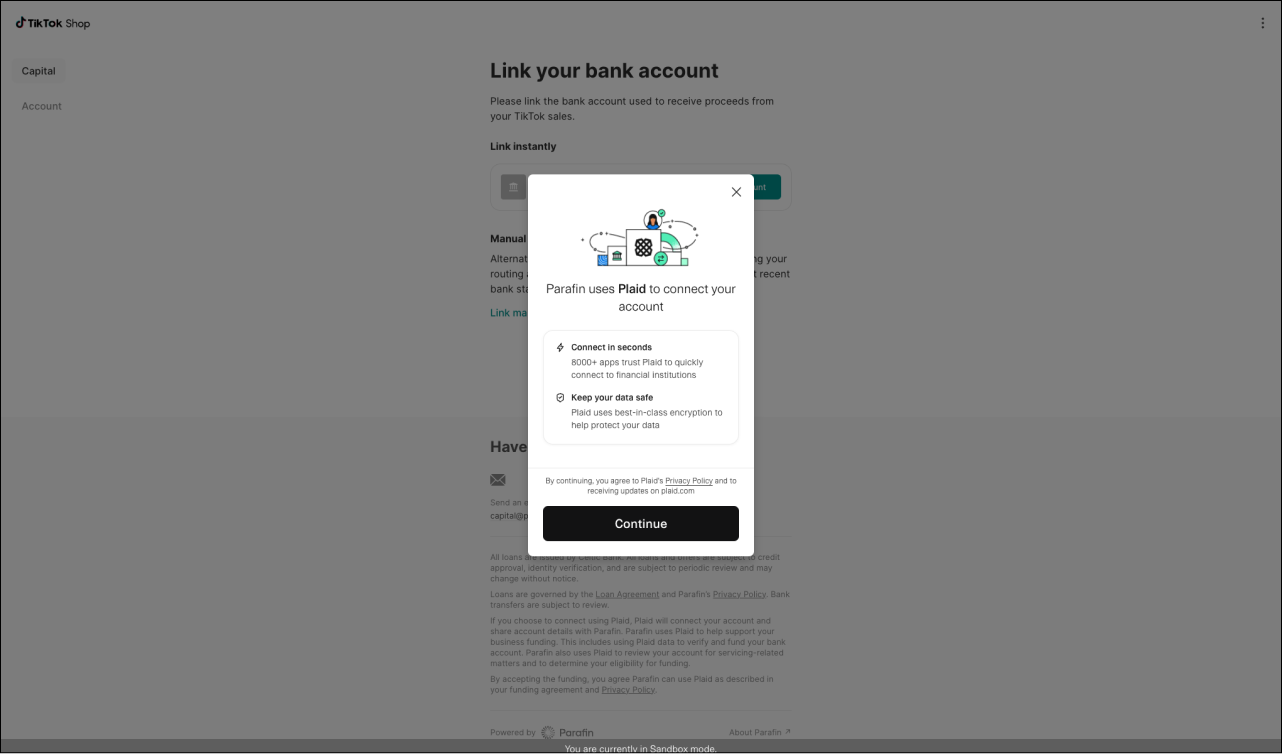

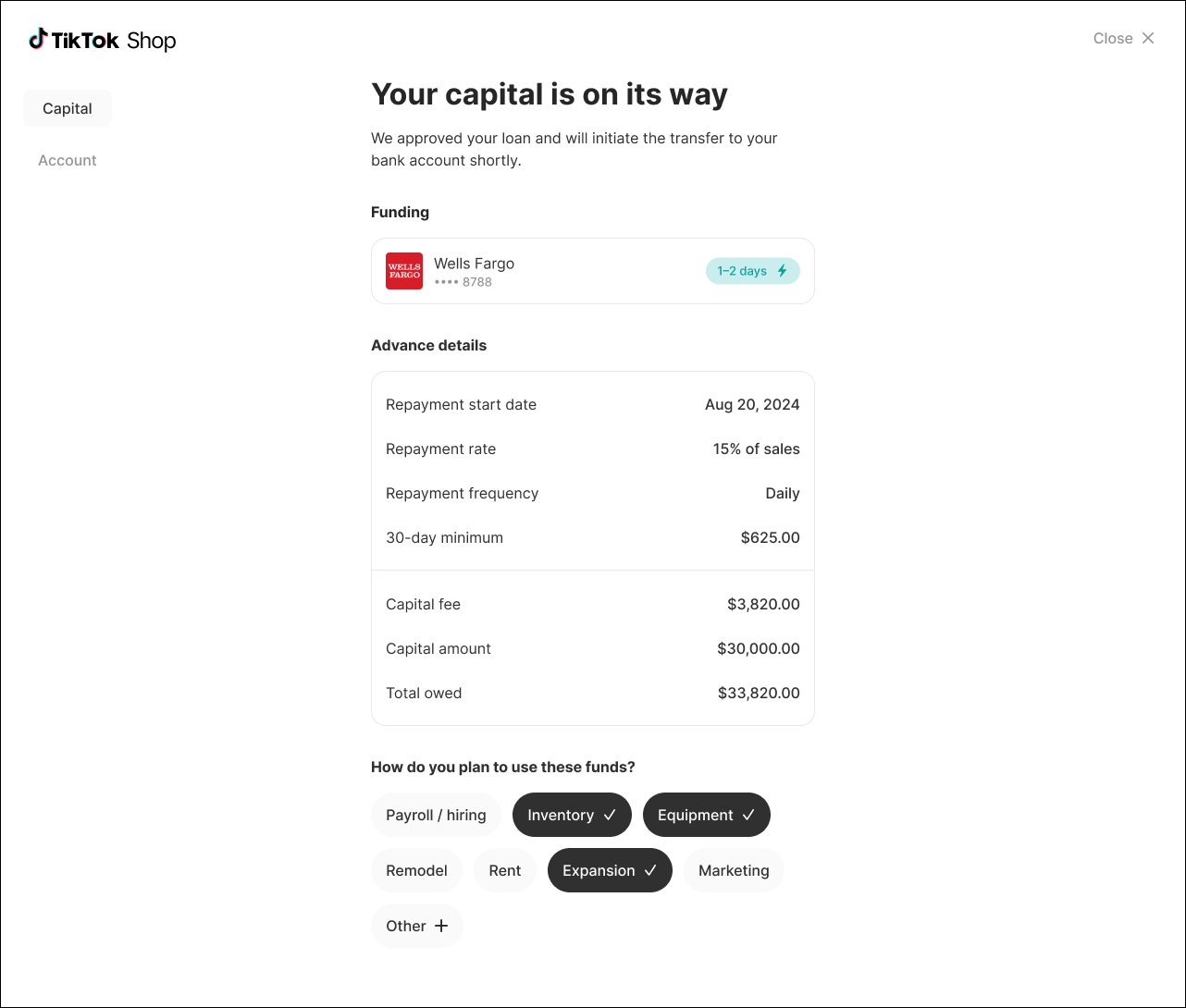

- Link the bank account associated with your TikTok Shop payouts. You can either use Plaid (by clicking "Link bank account") or manually link your account.

- If you are approved, you can review the loan details, and accept the funds. Once you click "Accept," Parafin will initiate the funds transfer.

- If successful, you will see a confirmation page with the same loan details. You will also receive a confirmation email, and an email when the funds have been deposited into your account.

Frequently Asked Questions

| Who is Parafin? | Parafin is a third-party partner that provides access to capital, such as Flex Loans. Parafin has obtained the necessary legal authorization to provide financial services in each state they operate. Financing programs through Parafin adhere to specific regulations and guidelines set by each U.S. state within its jurisdiction. All Parafin loans are issued by Celtic Bank. |

| How do I know if I am eligible? | If you are eligible, you will see a pre-approved offer from Parafin on the Capital tab in Seller Center. You may also receive an email or see a notification. |

| Does the offer expire? | Yes, eligibility is reviewed on a regular basis and based on recent sales history. |

| How does Parafin determine eligibility? | Parafin determines eligibility based on recent sales history on TikTok Shop. |

| How fast can I get approved? | Once you submit your application, you can get a decision in as little as 1 business day. |

| What is the capital fee? | The capital fee is one flat fee paid over the term of the loan. There are no other fees. |

| How fast can I get funding? | If approved, you can get funds in as little as 1 business day. |

| Can I have more than 1 Flex Loan at the same time? | At this time, you cannot have more than 1 Flex Loan at the same time. |

| Will this impact my credit score? | Applying will not impact your credit score. Parafin uses sales data to determine offer eligibility. There is no hard or soft inquiry. |

| How do repayments work? | For Flex Loans, repayments are daily and based on a fixed percentage of gross sales, not payouts. They are automatically debited from your bank account associated with your TikTok Shop payouts.There is a 30-day required minimum payment amount. You will see this amount in your offer details. |

| Are there restrictions on how I can use the funding? | Yes, Flex Loans can only be used for business purposes, such as inventory, marketing, fulfillment, payroll, product expansion. Funds cannot be used for personal or household expenses. |

| I have more questions. Who can I talk to? | You can look up more FAQs and/or contact Parafin's support team by clicking here. |