Beginner's Guide: What documents do I need to register?

09/18/2025

Summary

What are the key document requirements for setting up a TikTok Shop seller account?

- All documents must be valid, unexpired, clear, full images matching registration info, under 10MB, and in JPG, PNG, JPEG, or PDF format. Accepted IDs include US Passport, Driver’s License, State ID, or Permanent Resident Card only.

- Proof of legal name and residential address is required (IDs or unopened envelopes not accepted for address proof). Mismatched or unverifiable info may require additional documents like proof of business or a Letter of Authorization (LOA).

What specific documents are not accepted, and what happens if submitted documents cannot be verified?

- Expired documents, paper IDs, cropped info, photos of screens, and files over 10MB are rejected.

- If verification fails, sellers must provide extra proof such as proof of address, business, ID, or an LOA to complete registration.

What are the tax document requirements and thresholds for TikTok Shop sellers?

- Sellers can start listing and selling without tax documents until they earn $2,000 in sales.

- After reaching $2,000, tax documents must be submitted to continue selling and receive payments.

How can sellers obtain missing required documents like proof of address, proof of business, or a Letter of Authorization?

- Proof of address can be requested by contacting the issuing company’s customer service for email or mail delivery.

- Proof of business (IRS 147C) can be requested via the IRS website or by phone if the original CP 575 notice is lost.

- Letters of Authorization require contacting the listed business to determine the proper request process.

What tips or resources are available to help sellers ensure a smooth registration process on TikTok Shop?

- Double-check that ID information matches registration details exactly to avoid delays.

- Use TikTok’s Beginner’s Guide to Troubleshooting Sign-Up Issues if encountering login or registration problems.

- Sellers are encouraged to start their shop setup promptly to begin selling.

Requirements for All Documents

- All documents must be valid and not expired.

- Must be full image of the ID.

- The ID photo and personal information must be clear and visible.

- ID information must match the TikTok Shop registration information.

- Files must be less than 10 MB and in a JPG, PNG, JPEG, or PDF format.

✨ Seller Pro-Tip ✨ Double-check! Make sure the information on your ID matches the information you manually type in.

- Expired documents

- Paper form of identification

- Documents with information cropped out

- Photos of a computer or phone screen

- Files larger than 10MB

Note: If the information in the submitted documents cannot be verified, you will be required to provide additional proof of address, proof of business, proof of ID, and/or a Letter of Authorization (LOA).

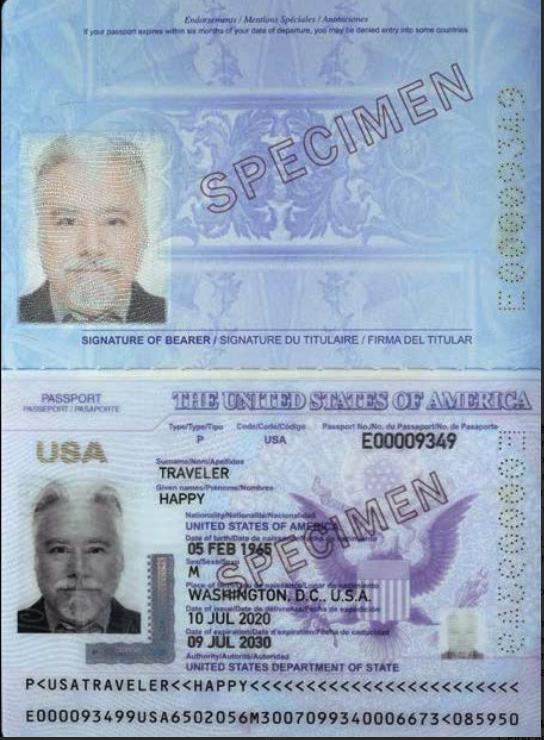

Identity Verification: United States Passport/Passport Card

The image of the passport must include all the following:

The image of the passport must include all the following:- Signature page

- Biographic data page with all the following information:

- First and last name

- Photo of the passport holder

- Passport number

- Date of birth

- Expiration date

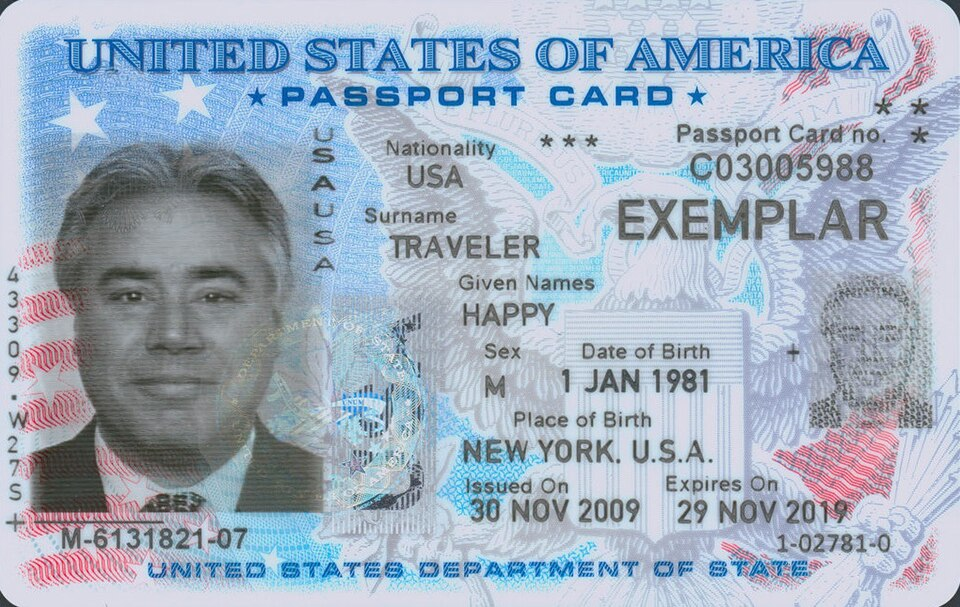

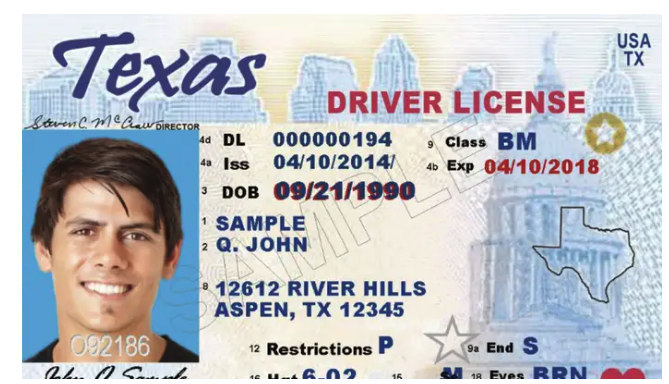

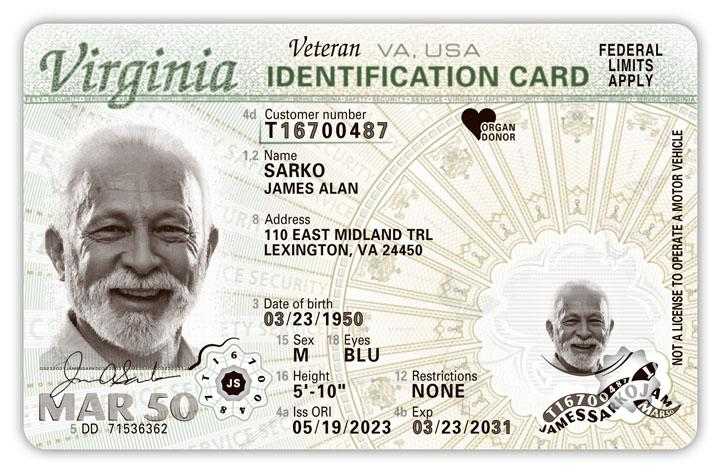

Identity Verification: United States Driver License or State ID

- First and last name

- License/permit number

- Date of birth

- Residential address

- Expiration date

Identity Verification: United States Permanent Resident Card

The image of your license or ID must show the following information clearly:

The image of your license or ID must show the following information clearly: - First and last name

- USCIS number

- Date of birth

- Expiration date

Upload a document showing legal name and residential address. IDs and unopened envelopes are not accepted. Be sure to enter the address as shown on your document, when signing up.

Proof of Business: IRS-Issued Document

- IRS 147 C

- IRS 252 C

- IRS CP 575 A

- IRS CP 575 B

- IRS CP 575 G

- IRS CP 575 E

- Legal business name

- Business address

- EIN (tax number)

- Date of notice

- A screenshot of the IRS website

- SS-4 Applications (or any IRS application to update or file information), tax returns, or e-file confirmations.

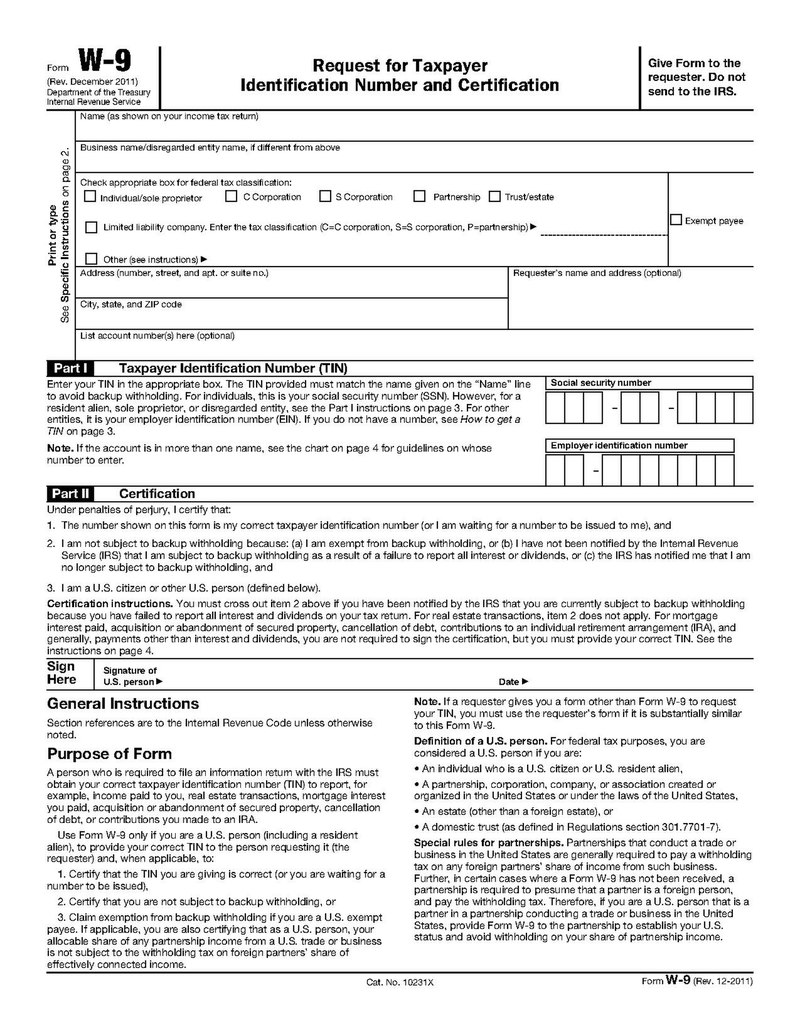

Tax Purpose: W9 Form

[For Corporation or Partnership] Other Forms For Tax Purposes

- Sole Proprietorship (Form W9),

- General Partnership (Form 1065),

- Limited Partnership (Form 1065),

- Limited Liability Partnership (Form 1065),

- C Corporation (Form 1120),

- Single-member LLC (Form 1040),

- Multi-member LLC (Form 1065 or Form 8832), Form 1120-S (S Corporation)

⚠️Hot Tip! You can start listing and selling products without tax documents, but only until you earn $2,000. To keep selling after that, and get paid for your orders, you must submit your tax documents.

[For Corporation or Partnership] Letter of Authorization (LOA)

For example, the LOA allows a person of authority to manage the TikTok Shop account on behalf of a business.

- Business name (If the LOA is typed on Parent Company letterhead, please ensure that the business name used in registration is also included)

- Authorized Representative's name

- Clear details about the person who has been authorized

- Role/title of the primary business representative and the authorized representative

- Signatures of the primary business representative and authorized representative

- Digital and handwritten signatures are accepted.

- Duration of the authorized letter (if any) (non-expired)

Need Help Finding Documents?

If you are missing any of the following required documents, you can follow the guidelines below to request them.- Proof of Address

- Proof of Business (IRS-issued document)

- Letter of Authorization (LOA): Contact the business listed on the LOA to determine the proper process for requesting or creating this document.

Ready to Register?

Kickstart your selling journey with us and set up your shop today!Need More Help?

If you're running into issues during login or registration, check out our Beginner’s Guide to Troubleshooting Sign-Up Issues.FAQs:

Individual Seller or Sole ProprietorshipHow will my documents be used? For instance, how will my passport be used in the system?

Who can register to sell on TikTok Shop?

Applicants must have a valid United States Passport, United States Driver License, or State ID.

Applicants must use a phone number and email address not already used to open another shop.

Applicants must reside in the USA.

Politicians are prohibited from becoming TikTok Shop sellers.

Why does TikTok need my business's EIN?

If I have multiple business names, which one should I use here?

FAQs: Ultimate Business Owner (UBO), Primary Business Representative

Who is an Ultimate Beneficial Owner (UBO)?

Why is an Ultimate Beneficial Owner (UBO) needed?

Identifying the Ultimate Beneficial Owner helps to verify the legitimacy and integrity of parties involved, maintaining a secure and trustworthy marketplace.

Can I submit a non-US passport for UBO verification?

Why do you need my Social Security Number (SSN) or Individual Tax Identification Number (ITIN)?

Please refer to the TikTok Shop Privacy Policy found here.

What is the difference between a UBO and a US Business Representative?

A US Business Representative is someone based in the US that is authorized to conduct business on behalf of the company. This can be anyone from the CEO to an entry-level marketing employee.

You may also be interested in

- 8 lessons

Setting up Your Shop

This module equips sellers with the essential knowledge to establish their TikTok Shop and manage th…

- 3 lessons

Getting Support

FAQs, answered!

Help Center Chat Assistant

Why use Help Center Chat Assistant? The Chat Assistant is designed to make managing your TikTok Shop…

How to register as a Corporation or Partnership

Easy Guide to Kick-Start Your Business on TikTok Shop - Business Entity What are the Requirements? A…

How to register as a Sole Proprietorship

Easy Guide to Kick-Start Your Business on TikTok Shop - Sole Proprietorship What are the Requirement…

How to register as an Individual

Easy Guide to Kick-Start Your Business on TikTok Shop - Individual Sellers What are the Requirements…

TikTok for Shopify: Migrating to Shopify from Third Party

This guide is designed to assist sellers in smoothly transitioning from third-party applications to…